Blog

Bitcoin Wikipedia

- October 15, 2025

- Posted by: admin

- Category: Uncategorized

Blogs

- The thing i don’t such regarding the extra

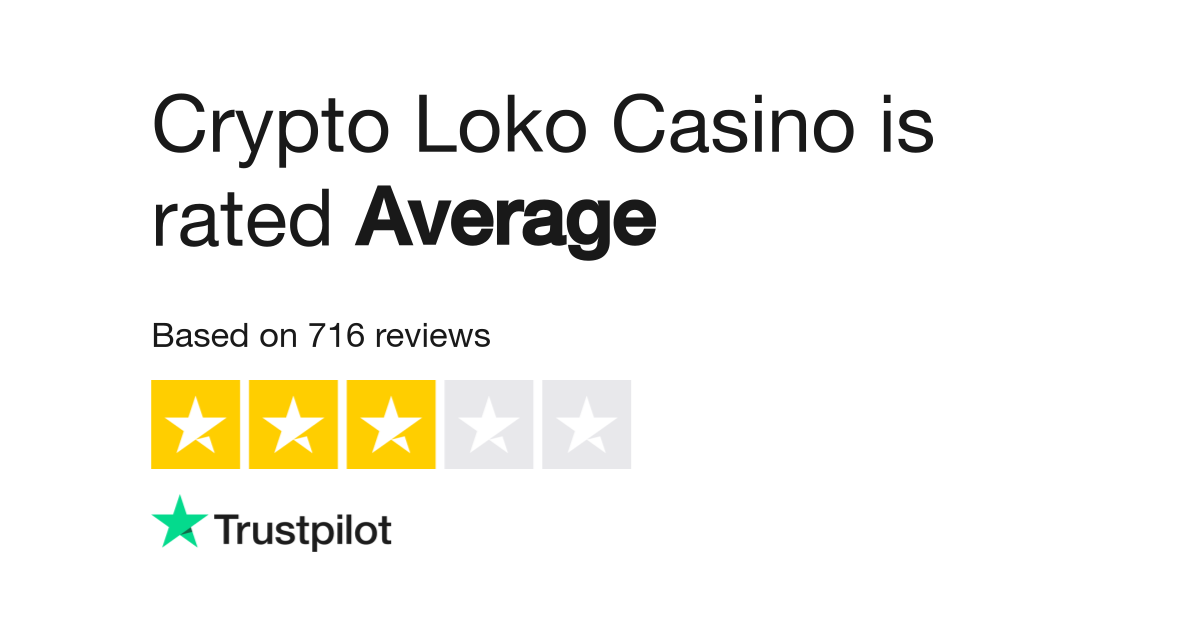

- Gambling enterprise Ratings

- Few days 38 2025 – 4 The newest No deposit Incentives

- FREED: Carl Beletsky Killed, Decapitated Partner in the Oconomowoc; Burned Direct inside the Timber Stove Tony Evers’ Killers & Rapists #8

- What is 7 figures within the currency?

- Learning to make dumps & withdrawals during the $step one casinos

HellSpin Local casino also offers a private one hundred% Invited Extra up to C$a hundred for brand new players who check in via an alternative advertising hook. Initiate your own enjoy in the Jackpot Urban area Casino having an enthusiastic 80 Totally free Revolves provide to your Wacky Panda after very first put. Local casino.org ‘s the community’s best separate online gambling power, delivering respected on-line casino information, books, reviews and you can information since the 1995. As mentioned, Growth Dream provides 1000s of tournaments to pick from. The new acceptance added bonus right here lets the new players to get in anybody of them tournaments, entirely risk-100 percent free.

The thing i don’t such regarding the extra

Even although you receive a distribution before you can is actually decades 59½, you may not need to pay the new 10% extra taxation when you are in one of the following the issues. As a whole, you need to tend to be the distributions (withdrawals) from your own conventional IRA on your own gross income. Although not, if your following criteria try satisfied, you can withdraw excessive benefits from your own IRA and not were the quantity withdrawn on your gross income. An excess share is the outcome of your own sum, their spouse’s sum, your own employer’s sum, otherwise an improper rollover contribution. If your company produces benefits on your behalf to a september IRA, see section 2 from Bar.

- But not, the lower entry way was created to make it more comfortable for professionals to get going.

- Within the 2024, using Setting 4797, your contour and you may statement the brand new $7,750 excessive depreciation you ought to include in your own revenues.

- For many who incorporated an excellent canceled amount on your own income and later pay the debt, you’re able to file a declare for reimburse for the season the total amount try included in earnings.

- Expand your $step 1 deposit subsequent by jumping anywhere between reduced-stake harbors.

Gambling enterprise Ratings

- You could potentially supplement their search for long-forgotten appreciate in the heart of an old forehead for ten cents for each spin.

- HSBC also will bring endless rebates on the third-team Atm charges in the usa.

- Estimated tax is the procedure familiar with spend tax for the earnings that isn’t subject to withholding.

- Both terminology is largely similar, but you’ll realize that sweepstakes providers buy the latter.

To work the brand new deductible quantity of the bullet-journey travelling expenses, use the pursuing the fraction. The mr. bet casino blackjack brand new numerator (better count) is the final amount of working days outside of the United states. The new denominator (bottom number) ‘s the total number from company and nonbusiness times of travel. Lower than Method 2, you can also play with any method that you apply constantly and you can that is according to realistic team habit.

Few days 38 2025 – 4 The newest No deposit Incentives

The newest company might also want to is $300 ($7,100000 − $six,700) inside the container hands down the employee’s Form W-2. This is the compensation which is over the product quality mileage rates. Sasha, a working artist, existence and you may performs within the Austin.

FREED: Carl Beletsky Killed, Decapitated Partner in the Oconomowoc; Burned Direct inside the Timber Stove Tony Evers’ Killers & Rapists #8

The best Golf ball Mania IV Competition is the largest kept thus much and you can provided an enormous $step three million bucks honor for the very first-lay winner. Immediately after joining a merchant account and you will wagering simply $step 1 or more, the newest winnings of one’s 2nd ten wagers will pay aside double. Per choice as much as $twenty five is approved for the strategy, plus the limit commission for every bet is actually $2500, so you can build an enormous parlay and possess a double payout whether it happens to victory.

What is 7 figures within the currency?

The bank as well as will provide you with a statement proving which you repaid $310 of interest for 2024. For individuals who itemize their write-offs to the Plan A good (Function 1040), you might deduct $310, susceptible to the net funding money limitation. Their employer’s contributions to a qualified senior years arrange for you aren’t utilized in income during the time contributed.

The newest letter have to reveal the total amount withheld as well as the effective day of the work with. For many who resigned to the impairment, you should use in earnings people impairment pension you get below an idea which is paid for by the company. You ought to declaration your taxable impairment payments on the internet 1h out of Setting 1040 or 1040-SR unless you arrive at minimum retirement age.

Learning to make dumps & withdrawals during the $step one casinos

Required costs designed to next county benefit fund is actually allowable while the state taxes to your Agenda An excellent (Form 1040), range 5a. Although not, the brand new imagine of the condition income tax responsibility shows that you are going to rating a refund of one’s complete number of your estimated fee. You’d no practical foundation to think you’d any extra accountability to possess state taxes and you will’t deduct the fresh projected tax percentage. Generally, you could potentially deduct possessions taxes only if you are a holder of the home.

You have to pay premiums out of $4.15 thirty day period under the employer B classification package. You profile the total amount relating to your revenue as the revealed inside Worksheet 5-step one. Figuring the cost of Classification-Life insurance coverage To include in Earnings—Illustrated next. Your employer should be able to inform you the total amount so you can use in your earnings. If the employer offers a product or service and you may the cost of it’s very short it was unrealistic on the employer in order to make up they, you usually don’t were its really worth in your income.

However, you can add on your kid’s assistance your away-of-pouch expenditures from working the vehicle to suit your boy’s work with. You ought to use the assistance sample individually to each and every parent. Your provide $2,100000 ($step one,100 accommodations, $step one,000 food) out of Aubrey’s complete support out of $4,100—not even half. You provide $dos,600 so you can Bailey ($step one,one hundred thousand accommodations, $step one,one hundred thousand eating, $600 medical)—more than half out of Bailey’s full service out of $4,700. Temperatures and you can power costs are within the reasonable local rental value of the rooms, so these commonly felt individually.

Another publication shows you various sort of sale from the courtroom on the internet sports betting web sites. Moreover it responses preferred questions regarding of a lot bettors has from bonuses. The only problem is one to several type of sportsbook incentives are present with different laws and regulations per you to.

If you discover a shipping out of your traditional IRA, you are going to discovered Mode 1099-R, otherwise the same declaration. IRA distributions are given inside packets step one and you will 2a out of Mode 1099-R. The amount otherwise letter rules inside the package 7 reveal exactly what form of distribution you received from your IRA.